child tax credit october 2021 date

Here are the dates for the final three Child Tax Credit payments. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail on Friday.

The Property Tax Handbook For Brrr Btl Investors By Joshua Tharby The Ultimate Tax And Account Property Tax Accounting Investors

The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments.

. Low-income families who are not getting payments and have not filed a tax return can still get one but they. October 20 2022. Ad The new advance Child Tax Credit is based on your previously filed tax return.

The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail on Friday. 1052 AM PDT October 15 2021. Around 36 million eligible American families will receive financial relief as part of the Child Tax Credit.

The 2021 advance monthly child tax credit payments started automatically in July. In previous years 17-year-olds werent covered by the CTC. Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children ages 5 and younger.

While the October payments of the Child Tax Program have been sent out many parents have said they did not receive their September check. Lets condense all that information. CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow.

Check mailed to a foreign address. Child Tax Credit 2022. How Next Years Credit Could Be Different.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Those who expect a payment. If you see the new IRS cycle for the year 2021 is 20210102.

Includes related provincial and territorial programs. Payment due on Tuesday January 5 2021. 3000 for children ages 6 through 17 at the end of 2021.

3600 for children ages 5 and under at the end of 2021. 152 PM EDT October 15 2021. 1 day agoThe following pages contain a sample tax return and corresponding tax return transcript.

Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit. Part of the American Rescue Plan eligible parents can get half of their allowance before the end of 2021 and the.

Since the IRS uses your 2019 or 2020 tax return your family may not qualify for the child tax credit payment when you file your 2021 tax return in 2022. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. President Biden has proposed making the Child Tax Credit permanent as part of the American.

October 14 2021 559 PM CBS Boston. In this case you may have to repay the IRS some or all of the credit. IRS code 290 with manytext_bing.

THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at 1159pm to decline it. 13 opt out by Aug. That means another payment is coming in about a week on Oct.

Payment will be made on Fri December 24. The child tax credit rules arent as flexible as the stimulus check rules regarding overpayment. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks.

The IRS will send out the next round of child tax credit payments on October 15. The Child Tax Credit has been expanded from 2000 per child annually up to as much as. Goods and services tax harmonized sales tax GSTHST credit.

That means parents. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax.

There are a number of changes to the CTC in 2021 because of the American Rescue Plan Act of 2021 which President Biden signed into law on March 11 2021. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 15 opt out by Aug.

The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of age. The money starts phasing out if you earn more than 75000 as a single tax filer or 150000 if youre a married couple that files jointly. Income limits associated with the expanded child credit are in effect for these payments too.

The advance is 50 of your child tax credit with the rest claimed on next years return. Wait 5 working days from the payment date to contact us. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Child Tax Credit Xmas Payment Dates 2021. The 500 nonrefundable Credit for Other Dependents amount has not changed. But many parents want to know when exactly.

According to CNET the payment will come when families file taxes for 2021 at the start of next year. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids. Following that is the interest and penalties if any levied on the balance and the most current date of these October 15 2021 at 1146 am.

December 13 2022 Havent received your payment. These payments are.

Universal Credit Statistics 29 April 2013 To 14 October 2021 Gov Uk

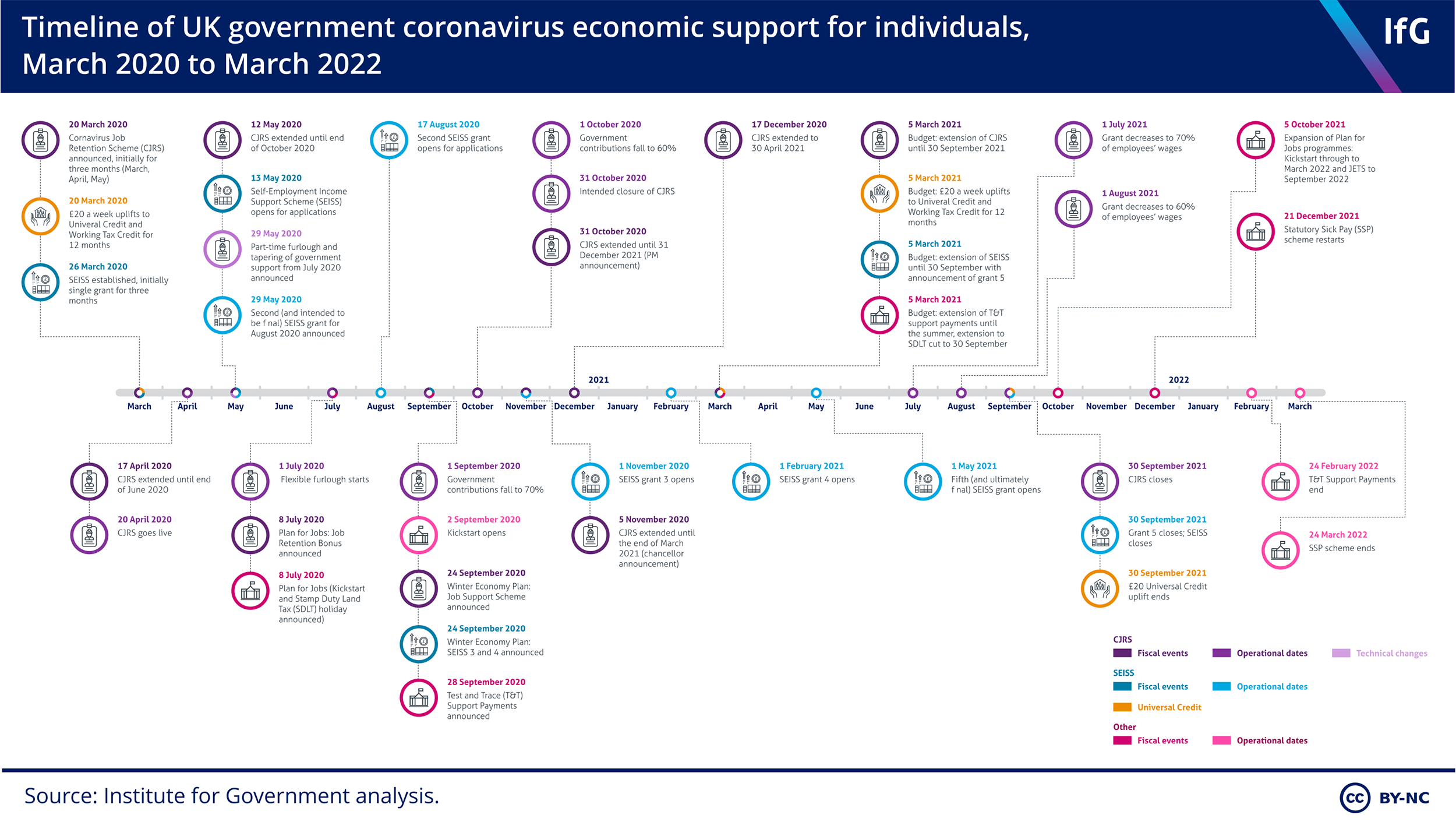

Coronavirus What Economic Support Did The Government Provide For Individuals And Businesses The Institute For Government

Tax Credits And Coronavirus Low Incomes Tax Reform Group

Tax Credits And Coronavirus Low Incomes Tax Reform Group

Child Tax Credit Dates Next Payment Coming On October 15 Marca

High Income Child Benefit Charge Issues On Separation Low Incomes Tax Reform Group

Child Tax Credit 2021 Here S When The Fourth Check Will Deposit Cbs News

Child Tax Credit Updates Why Are Some Ctc Payments Lower In October Marca

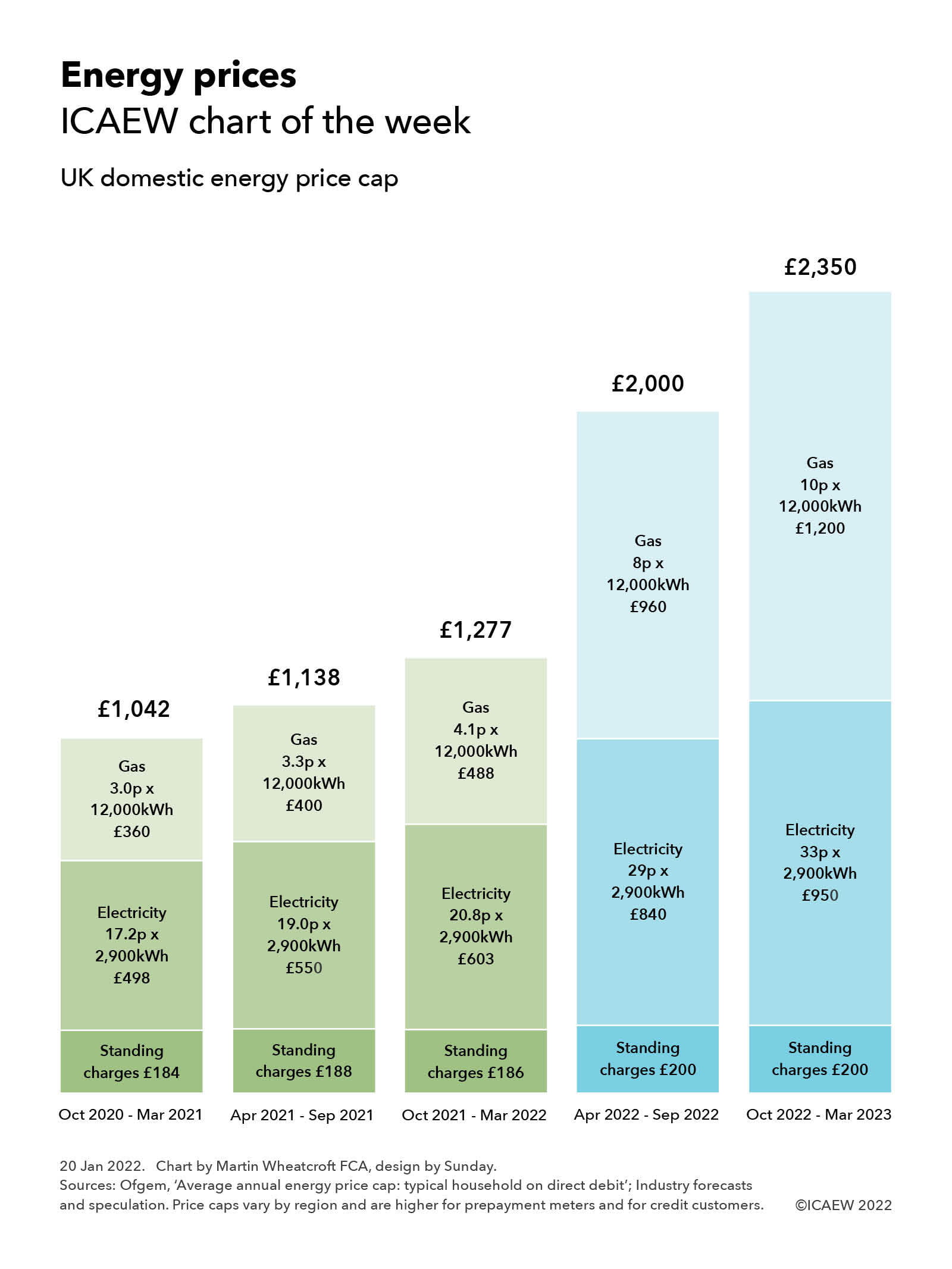

Chart Of The Week Energy Prices Icaew

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Child Tax Credit Updates Why Are Your October Payments Delayed Marca

Help To Save Savings Scheme Low Incomes Tax Reform Group

Did You File An Extension For Your Individual Tax Return You Have Until October 15 2021 To File Y Accounting Services Small Business Accounting Tax Extension

2021 2022 Tax Free Personal Allowance Increase Tax Rebate Services

Get Your Tax Return Done By 31 January If You Can Low Incomes Tax Reform Group